The market for food packaging is expected to be driven by the rise of the production of processed food. In addition, introduction of advanced packaging solutions coupled with the adoption of the same by companies across the globe is expected to drive food packaging market growth.

The global food packaging market size was estimated at $277.9 billion in 2017, exhibiting a compound annual growth rate (CAGR) of 5.1 percent from 2017 to 2024, according to research published by Grand View Research Inc. Growing demand for packaged food by consumers owing to quickening pace of life and changing eating habits is expected to have a major impact on the industry.

The agencies such as the U.S. Food and Drug Administration (FDA) have imposed stringent regulations regarding the use of plastics and other related materials for packaging that comes in direct contact with the food products. More consumers and manufacturers are shifting toward the use of sustainable and green materials for packaging food products.

Major market trends

The industry for food packaging is dynamic in nature, with the growth spurred by rising new product introductions aimed at keeping the food fresh for longer periods of time. Some of the major trends and developments in the food packaging market include:

- New packaging introductions: One of the major disruptive trends in the food packaging market was the introduction of paper-based, ready-to-eat meal packaging. For example, the packaging for "gluten-free power bar breakfast,"which was ideally a paper pouch-bowl type of packaging that provided ease of consumption of the contents, with an aesthetically pleasing finish, was one of the advanced innovations in the field of packaging.

- Coca-Cola’s Sustainable Packaging Strategy: In July 2017, Coca-Cola announced an advanced packaging strategy for the market in Great Britain, which envisaged increase of the recycled plastic content of its food packaging, from 25 percent to 50 percent by 2020. Initiatives such as these are expected to provide the necessary impetus to the market growth for food packaging.

- Kraft Heinz’s Sustainable Packaging Pledge: In August 2018, the company announced that it would make all of its food packaging recyclable, reusable or compostable by 2025. Earlier, the company also envisaged the reduction of its packaging material usage by 50,000 metric tons. As a result, such initiatives are expected to drive the growth of food packaging market

- The introduction of aluminum bottles to replace plastic is expected to emerge as one of the major market trends over the next eight years. In addition, growth of aluminum recycling activities across the globe is expected to drive the market for food packaging.

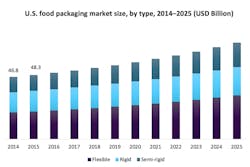

Chart courtesy of Grand View Research

The growth of the industry in the U.S. is expected to be fueled by an increasing urban population leading to growth in consumption of packaged food and growing popularity for single-serve packs. In addition, growth of industry is supported by increasing infrastructure for recycling of plastics, metals and glass. However, concerns regarding wastage due to improper packing may hamper the growth.

Major reasons that are likely to drive the market for food packaging can be summarized as follows:

- Growth of processed food market

- Ease of convenience related to the consumption of packaged food

- Introduction of advanced packaging

- Increase in shelf life achieved through the product use

Flexible packaging is the fastest growing segment exhibiting a CAGR of 5.9 percent from 2018 to 2025, according to research published by Grand View Research Inc., owing to its ability to form lighter, thinner, and compact packing. The market is expected to register a notable shift in the demand from rigid to flexible packaging due to superior performance and convenience offered by retortable packages and is presumed to exhibit the largest demand over the forecast period.

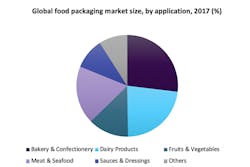

Increasing demand for smaller portions of meat and seafood is expected to drive the demand for packaging of these products. Emergence of fish and seafood as snack food is expected to drive the growth. Moreover, government initiatives to promote healthy eating habits is also expected to boost the demand for meat, poultry and seafood packaging.

Chart courtesy of Grand View Research

Strategic initiatives undertaken by packaging manufacturers

The industry is expected to be characterized by a number of strategic initiatives such as mergers and acquisitions, new product introductions, and capacity additions to increases to cater to the growing product demand. Some of the initiatives include:

- In May 2017, Amcor Ltd. announced the expansion of a specialty container business in Latin America through acquisition of Plasticos Team S.A.S. from Team Foods Colombia S.A.S. and acquired Bemis in August 2018 in a bid to improve the overall revenues of the company and create a major food packaging company

- In August 2016, Berry Plastics Inc. entered into a definitive merger agreement with AEP Industries, to acquire all of its share. AEP manufactures and markets an extensive range of polyethylene and polyvinyl chloride flexible plastic packaging products with consumer, industrial and agricultural applications. The company is expected to expand its product offering and production capacity.

- In August 2015, Sealed Air Corporation announced the acquisition of B+ Equipment, a France-based manufacturer of automated packaging equipment. The company plans to strengthen its position in the growing e-commerce segment through this acquisition.

Building on his experience in business intelligence and consulting projects, he has been involved in various critical business development model construction and has shown exemplary deduction skills for various markets in the materials, and food and beverage industry.