Markets Update: IIoT drives pump services market growth

IIoT, energy efficiency presents major growth opportunity for pump services market

The North American pumps services market is poised to experience significant disruption due to evolving end-user needs and rapid growth of enabling technologies like the Industrial Internet of Things (IIoT), a recent analysis found.

Frost and Sullivan, a global research firm, found two major growth opportunities within the industry: energy efficiency and the IIoT.

"Oil and gas, water and wastewater and chemicals are the primary industries driving the pumps services market. These are also the major consumers of advanced services, such as smart pumps," said Anand M. Gnanamoorthy, global leader for Industrial at Frost & Sullivan. However, while demand for traditional services will drive the growth in short-term, increasing end-user adoption of IIoT-based monitoring technologies will reduce their need for traditional pump service providers in the medium- to long-term. Therefore, pump manufacturers and service providers need to leverage their domain expertise by offering customized solutions for end users."

While oil prices have improved, they are still down 50 percent from the highs of 2014. As a result, end users need to reduce the cost of operation to increase profitability. Companies not only need to develop energy-efficient solutions but also focus on increasing customer awareness and showing customers the expected return on investment.

To succeed in IIoT, companies need to develop new business models such as gain sharing, pay-per-use, and product-as-a-service. This requires developing new strategies as end users themselves are unaware of the requirements and need to refer to use cases and best practices.

Pharmaceuticals are fastest growing segment in global packaging market

Growth in the world market for packaging machinery is expected to reach an estimated $42.2 billion by 2021, up from $36.8 billion in 2016, according to the Association for Packaging and Processing Technologies (PMMI).

PMMI represents more than 800 North American manufacturers and suppliers of equipment, components and materials.

Reasons for the global expansion include a growing middle class, heightened sustainability concerns, more spending power in developing regions, increased popularity of flexible packaging, demand for smart packaging like QR codes and augmented reality, and serialization.

While food is the largest industry sector at 40 percent and beverage is the second largest industry sector at 30 percent (all other industries account for the additional 30 percent), pharmaceuticals is the fastest growing sector, coming in with a CAGR of 4.1 percent.

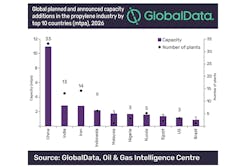

Asia will contribute 55% of global propylene capacity additions by 2026

Asia is forecast to be the major contributor to the growth of the global propylene industry between 2017 and 2026, accounting for around 55 percent of the global planned and announced propylene capacity additions by 2026, according to data and analytics company Global Data.

The company’s report shows that around 111 planned and announced plants are scheduled to come online, predominantly in Asia and the Middle East, over the next nine years.

Within Asia, China plans to add a total capacity of approximately 11.0 million tons per annum (mtpa) by 2026 with the help of 33 planned and announced propylene plants. Capital expenditure (capex) for these plants totals $7.3 billion over the next nine years.

Image courtesy of Global Data

Increased adoption of coal-fired power plants drives demand for coal handling system market

The coal handling system market is expected to remain on a steady growth path throughout 2018–2028, according to a new study from market intelligence company Fact.MR. The demand continues to remain influenced by increasing coal mining operations worldwide. In addition, surging use of coal in thermal power plants and coal-fired plants remain instrumental in driving worldwide sales.

Analysis reveals that the demand for the market is likely to translate into a significant sales volume surpassing 4,500 units by the end of 2028, projected to expand at a volume CAGR of 3.6 percent during the 2018–2028 timeline.

Asia Pacific excluding Japan (APEJ) is likely to retain its status quo as the most lucrative market for coal handling systems.

The emerging economies, particularly China and India, collectively accounted for more than 70 percent of the APEJ market in 2017 and are expected to showcase a significant market share by the end of the year of assessment.

This significant growth in the APEJ region can be attributed to substantial capacity increase in coal-fired power plants.