Industrial fans, blowers and compressors market outlook

Fans, blowers and compressors are all used to move air and gases. The many design types can be segmented based on pressure (see Table 1 below).

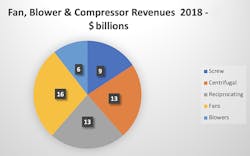

One option is to use multiple fans in series rather than one compressor. This is common for mechanical vapor recovery systems. Flow rates and price are additional variables that affect choice among fan, blower and compressor types. The total world market for fans, blowers and compressors in 2018 is $56 billion (see Figure 1 above).

Segmentation by industry

Fans are used in processing applications involving drying and combustion. The biggest market is coal-fired power. For example, a 1,000 megawatt (MW) boiler moves 4 million cubic feet per minute (cfm) of air with a sequence of fans. The combustion air is supplied by one fan. The exhaust gas is often driven by two fans. Fans are also used with dust collectors on coal-handling transfer points.

Table 1.

Mining applications require fans on kilns, dryers and ore-transfer points. Dryer fans are also common in the chemical, food and pharmaceutical industries. The exhaust gas from waste to energy, sewage incineration, steel electric furnaces and foundry cupolas is moved by fans tasked with overcoming 5 to 20 inches of water gauge (in. w.g.) pressure differential.

Blowers are used for applications such as pneumatic conveying, aeration and biogas transport. The market for blowers and lower pressure compressors in municipal wastewater treatment plants exceeds $1 billion per year. The biggest application is aeration, which is the largest energy consumer in a wastewater plant. Aerobic digestion is also used for organic waste in the food industry and in other industries.

Table 2. Blower market rankings by purchasing segment

Aeration is also required to oxidize calcium sulfite sludges to gypsum in power plant flue-gas desulfurization (FGD) systems. There was a big market for this application in the U.S. 20 years ago, in China 10 years ago and in India today. The cost of blowers for a single plant with multiple boilers can exceed $1 million. However, this outlay is small compared to that for fans at the same plant.

The food industry uses blowers for pneumatic conveying of powdered products. A growing use is to move biogas generated by anaerobic digestion of food waste.

The largest purchasing industry segment for blowers (not fans) is municipal wastewater (see Table 2). The U.S. market is fractured with 4,000 large plants and 12,000 small ones. The market is more concentrated in many other countries where decision-making is centralized. In some cases, this is due to one national wastewater entity. In others, it is due to ownership and operation by big international companies such as Veolia and SUEZ.

Refining is the second-largest blower market and is highly concentrated. One hundred refineries purchase most of the world’s blowers. Coal-fired power is highly concentrated with just 15 power companies operating 55 percent of the plants.

Figure 2. Distribution by region

Distribution by region

East Asia is the largest purchaser of fans and blowers, accounting for 30 percent of total purchases.

China is the dominant purchaser of fans and blowers with more than 50 percent of the world’s cement capacity and 40 percent of the coal-fired power capacity. China-based Guodian-Shenhua operates more fans and blowers than the entire coal-fired power industry in the U.S. and far more than in all of Europe.

One of the biggest new applications in North America is shale and gas fracturing. Fans and blowers are needed to dry the sand used in fracturing. Blowers are needed to convey the sand to and from the trucks. Blowers are also needed for processing the liquids and gases produced.

The supplier market share can be characterized by pressure and severity of service. Many suppliers in developing countries supply rotary blowers and lower pressure fans for general applications. As pressure, abrasion resistance, corrosion resistance and other severe-service conditions increase, the international supplier market share increases. Recently, international suppliers have been winning business for sewage sludge aeration blowers in China based on higher efficiency and lower energy consumption. Most countries have much higher energy costs than encountered in the U.S., meaning a more efficient blower can demonstrate a high return on investment.

Bob Mcilvaine is the president of the Mcilvaine Company in Northfield, Illinois. Mcilvaine provides market research and technical analyses on fans, blowers and related equipment. He may be reached at [email protected] or 847-784-0012, ext. 112.