McIlvaine: North America is the largest oil and gas valve market

Bob Mcilvaine is the president of the Mcilvaine Company in Northfield, Illinois. The Mcilvaine Company provides market research and technical analyses on oil and gas production equipment. Mcilvaine may be reached at [email protected] or 847-784-0012, ext. 112. Mcilvaine is a regular contributor to Processing. This column appeared in the April 2019 issue.

Next year, oil and gas companies will spend more than $3 billion for valves to be used in facilities based in North America — the United States, Mexico and Canada (NAFTA).1 Shale fracturing and its related technology has caused U.S. oil and gas production to soar and is the main reason this region will lead the market. Because the valve spend per gallon of oil extracted with hydraulic fracturing is much higher than with conventional extraction, there is a big valve market in these countries.

Hydraulic fracturing, also known as fracking, has increased in many parts of the world as other energy sources such as coal bed methane production stagnates or decreases. Fracking is a technique used by the energy industry to extract oil and gas from rock by injecting high-pressure mixtures of water, sand or gravel and chemicals.

While the U.S. will continue to lead production of shale gas, it will not be as significant in exports due to the country’s own high consumption needs. U.S. oil and gas production is projected to increase to about 18 percent of global production by 2040, up from 12 percent in 2016. U.S. oil and gas exports, however, are projected to only make up about 9 percent of the global market by 2040.

The techniques developed in the U.S. to fracture shale for the purpose of extracting oil and gas are the foundation of the success of the U.S. economy in the last decade. Developers have continually reduced costs with new techniques such as horizontal drilling. Valves are needed to control the sand, water and chemical mixture that is injected into the wells. The biggest use of valves is at the wellhead, however, valves are needed throughout the supply chain. The transport of sand with the correct fracking features from Wisconsin and Minnesota to West Texas has been very costly.

One of the most recent cost reductions is to manufacture high-quality sand from the lower quality resources available in the region. This has resulted in a significant valve market. The three main processes using these components are:

- Wet sand plants

- Dry sand plants

- Transload facilities

The challenge for designers of wet sand plants is that both the parameters of the incoming sand and the proppant end use change continually. Water use has to be integrated with the changing production needs.

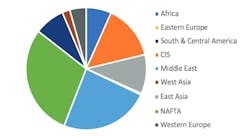

Figure 1. 2020 oil and gas valve spending by region (Note: Eastern Europe spending too small to be shown) Courtesy of the Mcilvaine Company

Valves are used with excavation of the sand through the wet sand separation process. Wet processing typically begins with either a horizontal or inclined primary vibratory screen. After exiting the screening process, hydrated sand in slurry form enters a sump and pump arrangement. Dewatering includes thickeners and filter presses. Many valves are needed for all the pipe connections.

The sand then is dried in a process where a number of valves and dampers are used for both the sand and the exhaust air for the drying system. In addition to major process requirements, there are minor ones such as valves for chemical injection and continuous emissions monitoring systems.

There is widespread use of rotary airlock valves in transload facilities. Railcars have to be connected to the facility to unload sand. Trucks then must be connected to remove the stored sand. Some facilities are designed to supply sand for 400 trucks per day.

The market for valves for fracking sand will continue to grow robustly in the U.S. The market is just developing in Argentina and China. The future looks very bright for the sale of these components in many countries around the world.

References

- Industrial Valves: World Markets, published by the Mcilvaine Company